Got an ambitious idea that needs more than just a little bit of money to take off? Maybe you’ve heard stories of startups that went from a small team to a huge company with the help of powerful investors. This level of growth often requires a type of funding that’s bigger than what friends, family, or even angel investors can provide.

To put the scale into perspective, Indian startups alone secured over $13.7 billion in funding from Venture Capital firms in 2024. This is where Venture Capitalists (VCs) come in. They are key players who provide the fuel for high-growth startups to go from a promising idea to a market leader.

This blog post is designed to be your complete guide to Venture Capitalists. We’ll start by explaining who VCs are, how they differ from other investors, and the types of companies they look for. We’ll then break down the pros and cons of taking their money, so you can make an informed decision for your business. By the end, you’ll have a clear understanding of what VCs are all about.

What is a Venture Capitalist?

A Venture Capitalist (VC) is a professional who invests money into young, fast-growing companies, usually startups. Unlike angel investors who use their own personal money, VCs manage large pools of money that come from other sources. These sources can include big financial organizations, pension funds, university endowments, and very wealthy individuals. VCs are essentially experts at finding and funding businesses that have the potential to grow very big, very quickly.

Key Characteristics and What Venture Capitalists Do

-

Invest Other People’s Money

The most important thing to know about VCs is that they are investing funds collected from various investors, not just their own personal wealth. They have a responsibility to these investors to make smart choices that will lead to high returns.

-

Focus on High-Growth Companies

VCs specifically look for companies that can expand rapidly and become leaders in their market. This often means investing in technology companies, innovative service providers, or businesses that can change an entire industry. They are not typically interested in small businesses that aim for slow, steady growth.

-

Seek Significant Company Ownership

In exchange for the large sums of money they provide, VCs take a notable share of ownership (equity) in the startup. They become part-owners of the company, which aligns their success directly with the startup’s success.

-

Aim for High Financial Returns

VCs invest with the goal of making a very large profit on their investment. They achieve this when the startup they funded is either bought by a larger company (an “acquisition”) or sells its shares to the public on a stock market (an “Initial Public Offering” or IPO). They are looking for a significant return on their investment within a few years.

-

Provide More Than Just Money

Beyond the capital, VCs often offer strategic guidance, valuable connections, and hands-on support to the startups they invest in. They can help with hiring, marketing, business strategy, and even finding future investors. Their experience and network can be very helpful for young companies.

-

Invest Larger Amounts

Compared to angel investors, VCs typically provide much larger sums of money in their investment rounds, often ranging from millions to tens of millions of dollars. This larger capital is meant to fuel rapid expansion and market capture.

-

Driven by Scalability and Disruption

VCs are highly interested in business models that can scale quickly to serve a large number of customers without a proportional increase in costs. They also look for startups that have the potential to disrupt or significantly change existing markets and industries with new solutions.

What is the Difference Between Angel Investor and Venture Capitalist?

While both Venture Capitalists (VCs) and Angel Investors provide crucial funding for startups, they operate in different ways and often at different stages of a company’s growth. Understanding these distinctions is important for founders looking for the right kind of investment. (For a deeper dive into Angel Investors, you can check out our comprehensive guide on Angel Investors: Your Complete Guide to Early-Stage Funding).

Here are the main ways VCs and Angel Investors compare:

| Angel Investors | Venture Capitalists | |

Source of Funds |

These individuals invest their own personal money. Their funds come directly from their private wealth. | VCs manage money that comes from other large sources, such as big companies, pension funds, university funds, and very wealthy families. They are investing on behalf of these outside investors. |

Investment Size |

Angel investments are generally smaller, often ranging from a few thousand to a few hundred thousand dollars in a single round. | VCs typically make much larger investments, often starting from millions of dollars and going up to tens or even hundreds of millions in later funding rounds. |

Stage of Investment |

Angels usually invest in the very early stages of a startup, often when it’s just an idea, has a basic product, or is just starting to get its first customers (known as pre-seed or seed stage). | VCs generally invest in later stages, once a startup has a proven product, a growing number of customers, and clear signs of market acceptance (often Series A, Series B, and beyond). |

Decision-Making Process |

An angel investor’s decision to invest can often be made by one person or a small group within an angel network. The process can sometimes be quicker. | VC firms have formal investment committees that make decisions. This involves more people, more detailed reviews, and a more structured process, which can take longer. |

Level of Involvement |

Angels often have a more direct, personal, and sometimes hands-on relationship with the founders, offering mentorship and advice based on their own experiences. | While VCs also provide strategic guidance and connections, their involvement tends to be more formal, often through board seats and focusing on high-level strategy and financial oversight rather than day-to-day operations. They oversee a portfolio of many companies. |

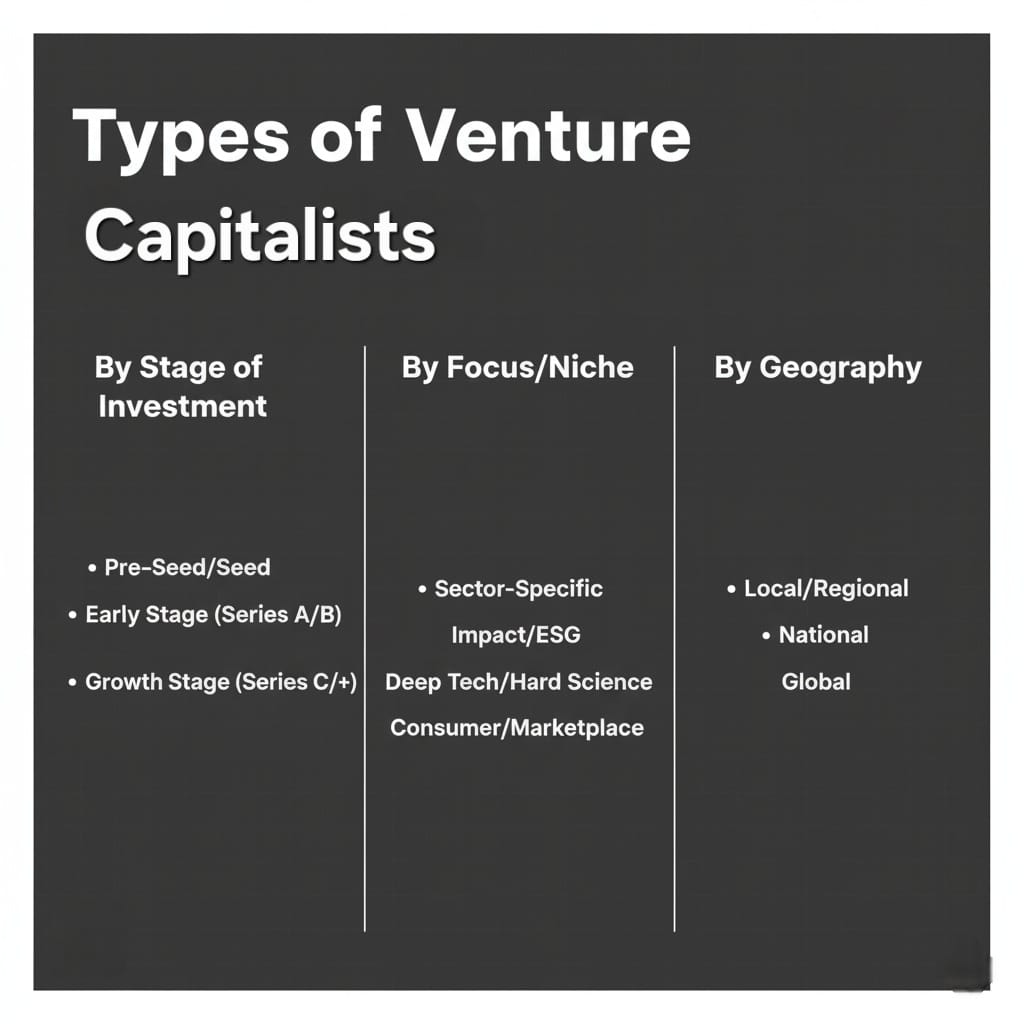

Types of Venture Capitalists (and VC Firms)

Venture Capitalists (VCs) are not all the same. They often specialize in different areas, which can be very helpful for startups looking for the right kind of funding and support. Knowing these types can help you find investors who are a good fit for your specific business.

By Stage of Investment

Seed-Stage VCs

These firms invest in the very earliest ideas, sometimes even before a product is fully built or a company has many customers. They are looking for strong teams and big market opportunities.

- Example: Blume Ventures is a well-known seed-stage VC firm in India that has backed many companies right from their early days.

Early-Stage VCs

These VCs invest when a startup has a working product and some early customers, but needs more money to grow quickly. This is typically for “Series A” or “Series B” funding rounds.

- Example: Accel India is a prominent early-stage VC firm that has invested in many Indian startups as they began to scale, including Flipkart in its early days.

Growth-Stage VCs

These firms invest in more established startups that already have significant revenue and a large customer base. They provide large amounts of capital to help these companies expand even further, sometimes globally, or prepare for a public stock offering.

- Example: While many VCs invest across stages, firms like Tiger Global Management (a global firm with significant investments in India) often participate in later, larger growth-stage rounds for successful Indian startups like Flipkart and Ola.

By Focus/Niche

Sector-Specific VCs

Many VCs choose to focus on a particular industry or type of technology where they have deep knowledge. This allows them to better understand the startups they invest in and provide more specialized advice.

- Fintech VCs: Invest in companies building new financial technologies (e.g., payments, lending, banking apps). Example: Elevation Capital has a strong focus on Fintech, with investments in companies like Paytm.

- Healthtech VCs: Focus on startups using technology to improve healthcare (e.g., online doctor consultations, health tracking apps). Example: Many firms, including Nexus Venture Partners, have invested in Healthtech startups like Practo.

- SaaS VCs (Software as a Service): Invest in companies that provide software as a subscription service over the internet. Example: Kalaari Capital is known for its investments in SaaS companies in India.

Impact VCs

These VCs invest in companies that aim to create a positive social or environmental impact alongside financial returns. They look for businesses that solve important societal problems.

- Example: Omidyar Network India is an impact investor that supports startups working on areas like financial inclusion, education, and digital identity for the masses.

Corporate VCs (CVCs)

These are investment arms of larger established companies. They invest in startups that might be strategically important to their main business, often looking for new technologies or market trends.

- Example: Info Edge Ventures (the investment arm of Info Edge, which owns Naukri.com and 99acres.com) is a corporate VC that invests in early-stage startups, often in areas related to their existing businesses.

By Geography

Local VCs

These firms focus their investments primarily within a specific country or region, often having deep networks and understanding of the local market.

- Example: Many of the firms mentioned above, like Blume Ventures (Bengaluru-based), are primarily focused on the Indian startup ecosystem.

Global VCs Investing in India

These are large international VC firms that invest worldwide, including a significant presence in India. They bring global perspectives and larger capital.

- Example: Peak XV Partners (formerly Sequoia Capital India) is a global VC firm with a very strong presence and many successful investments in India.

Understanding these different types of VCs can help founders target the right investors who align with their startup’s stage, industry, and overall vision.

What Do Venture Capitalists Look For in a Startup?

Venture Capitalists (VCs) see thousands of pitches every year but only invest in a very small number of companies. To get their attention, a startup needs to show that it has the potential for massive success. Here are the key things VCs are looking for:

1. A Strong, Experienced Team

VCs often say they invest in the team first and the idea second. They want to see a founding team with the right mix of skills, experience, and a deep understanding of their industry along with passion, dedication, and the ability to learn and adapt quickly. They also want to see that the founders can attract and keep great talent and need to believe that this is the right team to handle the ups and downs of building a high-growth company.

2. A Large Market Opportunity

VCs are not interested in businesses that serve a small or limited market. They want to see that your startup is solving a big problem for a large number of people. This means the market for your product or service must be huge, with a high potential for growth. They’ll want to see data and research that proves this market is not only big but also growing, and that there’s a real need for your solution.

3. An Innovative Solution or Product

VCs are looking for something new and different. They don’t want to fund a company that’s just a slight improvement on an existing idea. They want to see a unique value proposition—something that sets your product or service apart from all the others. This innovation could be in the technology itself, the business model, or the way you reach customers. Your solution must be so good that it could change or “disrupt” the market.

4. Proof of Progress (Traction)

While VCs invest in future potential, they also want to see proof that your idea is working today. This proof is called “traction.” Traction can be early user growth, positive customer feedback, a growing email list, or, most importantly, early revenue. It shows that people are willing to use or pay for what you’ve built. Having solid numbers and metrics that show consistent growth gives VCs confidence that your business is not just a theory.

5. A Scalable Business Model

VCs need to be convinced that your startup can grow very fast without your costs growing at the same rate. This is what “scalability” means. They’ll look at your business model to see if it can easily handle a massive increase in customers. A business that requires hiring a new person for every new customer, for example, is not scalable. VCs are looking for a model that can grow exponentially through technology or other efficient processes.

6. A “Defensible Moat”

A “moat” is a special advantage that makes it hard for competitors to copy or compete with you. This could be unique technology that is protected by a patent, a strong brand that customers love, or a network effect (where the product becomes more valuable as more people use it, like a social media app). VCs want to know what your moat is and how it will protect your business from competition over time.

7. A Clear Vision and Exit Potential

VCs are investing money with the expectation of making a big return. They want to hear a clear vision for where the company is going and a plausible path for how they will eventually get their money back. This “exit” is typically through an acquisition (being bought by a larger company) or an IPO (going public). Your pitch must show a clear, ambitious long-term plan that has a clear path to a valuable exit in the future.

Pros and Cons of Venture Capitalists

Securing venture capital funding can be a game-changer for a startup with high-growth potential. However, it’s not without its drawbacks. Founders need to carefully weigh the advantages and disadvantages before pursuing this path.

Advantages of Venture Capitalists

1. Substantial Cash Injection

Unlike many other funding sources, VCs can provide a large amount of capital in a single investment round. This cash can be used to scale operations quickly, hire top talent, invest heavily in technology and marketing, and get a significant head start on competitors. This is often the fuel a startup needs to grow at a rapid, high-impact pace.

2. Access to Expertise and Network

VCs bring more than just money to the table. They often have deep industry experience and a wide network of contacts. This means they can provide strategic guidance, valuable mentorship, and introductions to potential customers, partners, and future investors. This support can be invaluable for navigating challenges and making smarter decisions in a competitive market.

3. Enhanced Credibility and Validation

Being backed by a reputable VC firm is a powerful signal to the market. It tells customers, partners, and potential employees that your business idea has been vetted by professionals who believe in its success. This “stamp of approval” can make it easier to attract top talent, secure partnerships, and raise money in future funding rounds.

4. No Repayment Obligations

VC funding is not a loan. You do not have to pay it back with interest. This removes the financial pressure of monthly repayments and allows the startup to reinvest all its revenue back into the business for continued growth. The investors only make money if the company succeeds and is sold or goes public.

Disadvantages of Venture Capitalists

1. Loss of Significant Equity and Control

In exchange for the investment, VCs take a large share of ownership (equity) in your company. As you go through multiple funding rounds, your ownership percentage as a founder will get smaller. VCs also often demand a seat on the board of directors, which gives them a formal say in big decisions. This can mean you lose some control and may have to compromise on your original vision.

2. Intense Pressure for High Growth

VCs invest with the expectation of a very high return, typically within a 5-10 year timeframe. This puts immense pressure on a startup to achieve rapid, and sometimes aggressive, growth goals. This “grow-at-all-costs” mindset can lead to long hours, stress, and may not be the most sustainable path for every business.

3. Potential for Misaligned Goals

Sometimes, the VC’s goals may not align perfectly with yours as a founder. For example, a VC might push for a quick sale of the company to get their return, while you might want to build the business for a much longer time. Disagreements over strategy, culture, or the future direction of the company can create tension.

4. Time-Consuming Fundraising Process

Securing VC funding is a very long and difficult process. It can take many months of preparing materials, networking, pitching to numerous firms, and undergoing intense due diligence. This can be a huge distraction for founders, taking them away from the critical work of actually building and running the business.

5. Irreversible Decisions

Once you take money from a VC, the decision is generally final and comes with long-term consequences. The terms of the investment are legally binding and can be difficult to change. It’s not something you can easily reverse if the relationship doesn’t work out or if you later decide the VC path wasn’t right for your company.

Conclusion

Venture Capitalists are a critical part of the startup world, providing the large investments needed to fuel rapid growth and market disruption. They are professionals who offer more than just money; they also bring valuable expertise, networks, and credibility to the companies they fund. However, taking their money is a big decision that comes with its own set of trade-offs, including giving up company ownership and facing pressure for fast growth.

For any founder with a high-growth business idea, understanding Venture Capitalists is an essential step. It’s about more than just finding money; it’s about choosing a strategic partner for your company’s future. Carefully weighing the pros and cons and ensuring your goals align with theirs is the key to making a successful and lasting partnership.

Ready to dive deeper into the world of funding and entrepreneurship? Head over to Startup Words! We’ve got more guides on everything from the basics of business terms to advanced strategies for your pitch deck. Whether you’re looking for funding or just trying to grow your side hustle, our resources are here to help. Come explore and become part of a community that helps each other succeed!